Managing Human Risk for PCI DSS Compliance

Credit cards have become the primary way people make purchases, especially with the growth of online shopping. Credit cards are incredibly convenient, allowing people to make large purchases almost anywhere in the world.

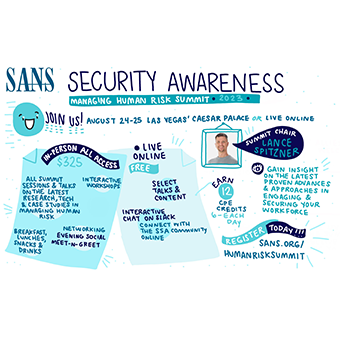

_Joins_Forces_with_SANS_Security_Awareness_-_340x340_Thumb.jpg)